Simple Tips About How To Buy Roth Ira

/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

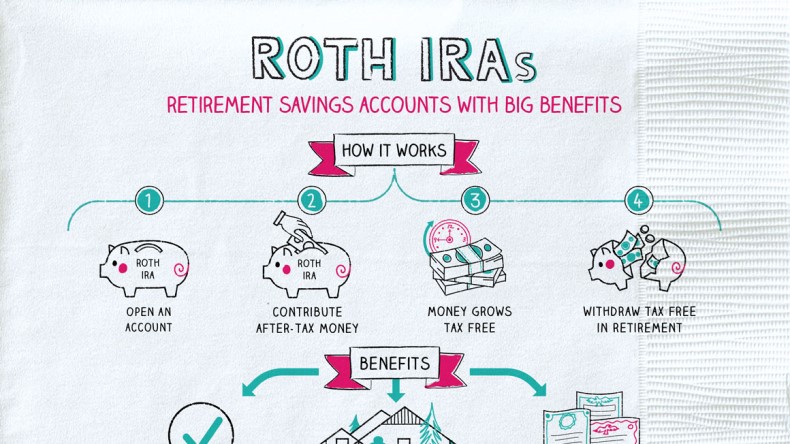

One interesting thing about the caps the roth and traditional are 6k a year combined.

How to buy roth ira. House storage gold ira the house storage gold ira offers capitalists the ability to purchase physical precious metals like silver and gold without stressing over inflation or tax obligation. You can contribute to both in a year but max is 6k. Td ameritrade offers a $0 account minimum and commissions of $9.99 per trade.

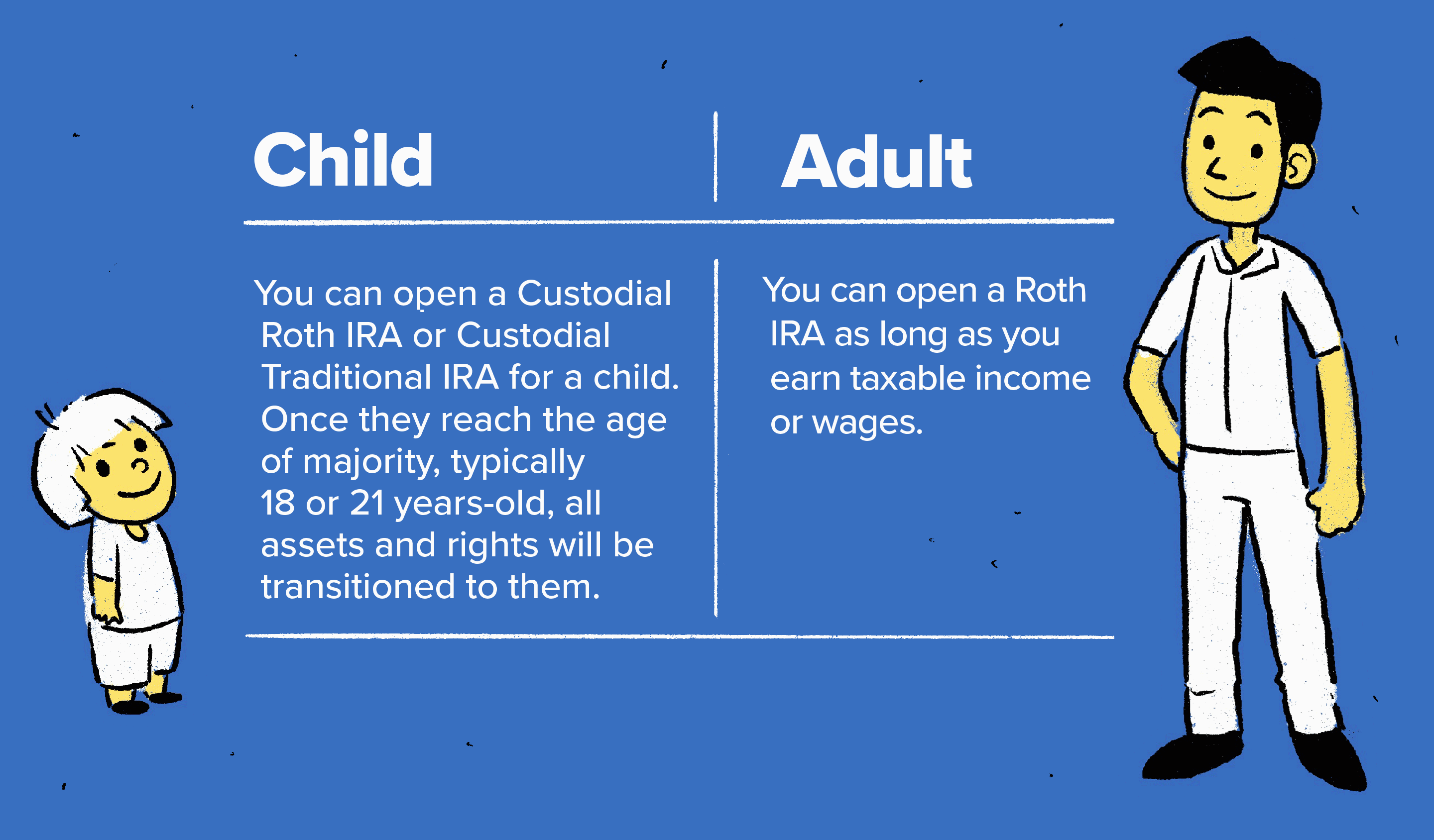

It is considered a total market fund, which. Instead, the roth ira must purchase shares with its own assets in order to own shares. You cannot deduct contributions to a roth ira.

Fzrox is the top mutual fund, based on the lowest fees, within the category of u.s. A roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira. Open a schwab brokerage account online.

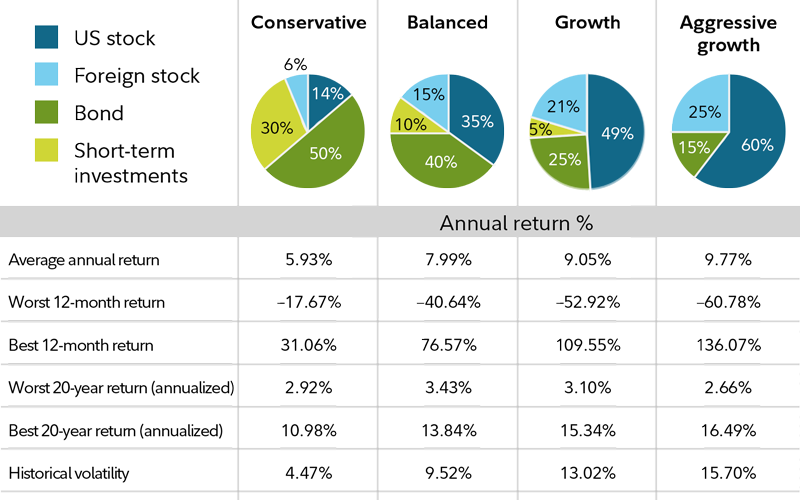

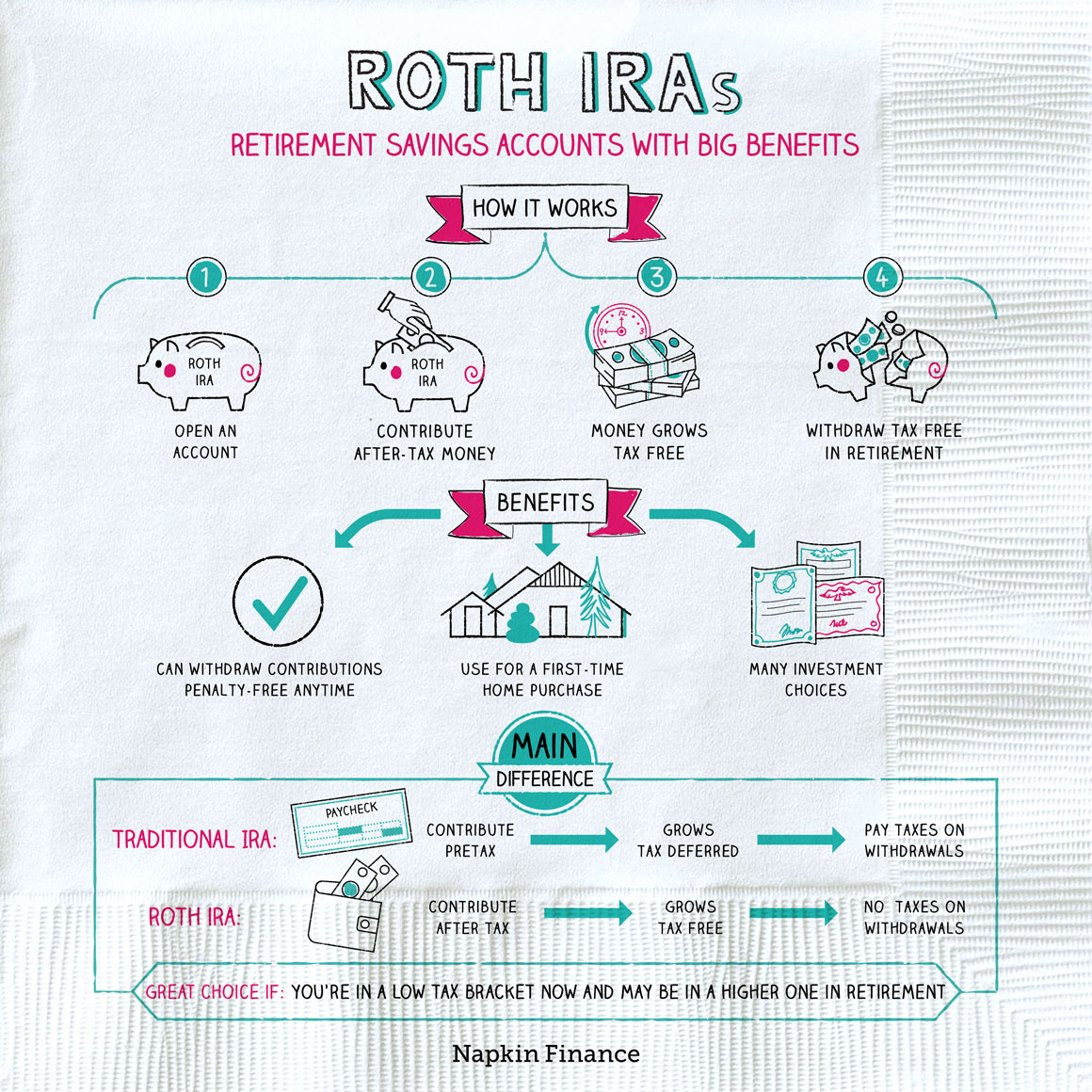

Ad we reviewed the 10 best gold ira companies for you to protect yourself from inflation. First, here’s a quick explanation of how a roth ira works: Everything that you need right here for you!

Get an analysis of your current portfolio, assess your financial situation, and find ideas to help you. Additionally, you don't have to pay taxes when you make qualified withdrawals. Here are 3 ways to help get started when investing in an ira.

More than two hundred hours of research to provide the top financial knowledge. To reduce the chances you’ll get hit with taxes or unexpected penalties when making an early roth ira withdrawal for a home purchase, follow these steps: If your 401k allows it you can contribute to a roth.

Which means finding another current owner (besides arden), who is not a disqualified. Substantially higher maximum annual contribution. However, allocating a portion of one’s roth ira to a momentum.

For the 2021 and 2022 tax years, you. A roth ira is a special type of individual retirement account. Ad access proprietary research & tools.

:max_bytes(150000):strip_icc()/rothira_final-e893b63825fd418fa3787f38361be956.jpg)

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)