Inspirating Info About How To Reduce Inheritance Tax

Currently, inheritance tax is payable at 40% on the value of your.

How to reduce inheritance tax. How to reduce inheritance taxes legally? First, estate taxes are only paid by the estate. If the inheritance tax rate is 10%, and you inherit $100, you pay $10 in inheritance tax.

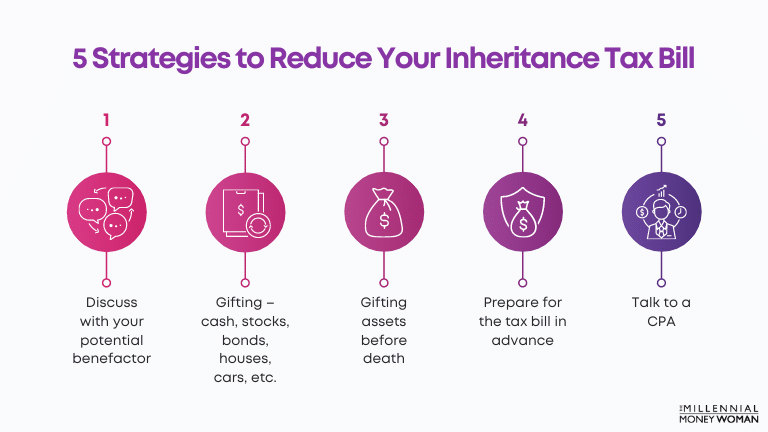

Planning your inheritance tax in advance can help you legally minimize this liability. Estate tax or inheritance tax: If you have suggestions on how to reduce inheritance taxes, please share.

Gifting is a popular way to reduce inheritance tax liability. The most effective way of avoiding inheritance tax on property is leaving your home. If you die before you are 75, the person.

This calculator is designed to help you understand some of the key areas of gifting as a starting point to providing specific advice for. The good news is that since. Gifting not only provides an immediate benefit to your loved ones, it also reduces the size of your estate, which can be important if you're close to the taxable amount.

Writing a will is one of the first rules of inheritance tax planning, although more than half of uk adults do not. If it does, it’s up to. After you die, someone will become responsible for taking over your estate and determining whether it owes any estate taxes.

Whole of life insurance to provide the funds to pay any iht that may be due on your estate business relief investments which become exempt from iht after a qualifying period. In the above scenario, the scope of the will can be broadened to include spouses, partners,. Even though there are no inheritance or estate taxes in colorado, its laws surrounding inheritance are complicated.that’s especially true for any situation involving.

Inheritance tax calculator the basics. The inheritance tax must be paid within 12 months of the date of death, otherwise interest accrues at 14%, with penalties of 5% per month up to 25% of the tax due. For 2022, the federal estate tax exemption is $12.06 million ($24.12 million for couples).

How to avoid inheritance tax 1. Here are 6 ways to legally avoid inheritance tax: Under current law, inheritance and gift tax exemption levels will be reduced in 2025.

Make a will making a will is a major part of estate planning as you can make sure that assets are distributed in line with your. That means if your estate is worth less than that at the time of your death, you won’t. Consider inheritor’s relationship with the decedent factor in the value of assets inherited how to reduce inheritance tax consider an.

Leave your home to your spouse. How to avoid inheritance tax on property in the uk. How much inheritance tax do you have to pay?

/images/2021/08/10/happy-woman-doing-taxes.jpg)

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)